The 3-Minute Rule for Mortgage Brokers Melbourne

Do some study and understand your broker's costs prior to authorizing anything. If you don't have time to penetrate the home loan application procedure, or if you remain in a rush to safeguard a home mortgage, employing a broker is a smart choice. Just know the prospective downsides entailed. Do not just choose an arbitrary broker.

Even with whole lots of recommendations, be certain to ask a lot of questions before agreeing to work with a home loan broker. Locate out just how that broker obtains paid and also get a sense of his or her experience.

A financial institution will offer the debtor with the choices they can offerthat might be just two or 3 car loan products. A mortgage broker, by contrast, will certainly recognize loads of loans and policies, and also will certainly suggest those which are most beneficial to the lending institution. If a possible debtor is rejected by a bank since they do not get its borrowing program, the person may be inhibited from attempting againwhen in reality a home mortgage broker might have informed them that they may be approved by a different loan provider with a different policy.

All about Mortgage Brokers Melbourne

:max_bytes(150000):strip_icc()/buy-house-with-cash-2000-6d1807f85ef24582a533aeb0753afc42.jpg)

If it is dropping far short, she might suggest that the mortgage holder carries out re-financing to acquire a various passion price. A broker is not obliged to have regular check-ins, nevertheless. Some brokers are paid greater or reduced fees for sure products, while others get a level cost.

65% of the overall finance amount. 35% of the value of the residence financing. Some brokers are beginning to bill the customer a fee in addition to charging the loan provider.

There are numerous ways to get a mortgage. You can go directly to your financial institution or cooperative credit union and also utilize a dedicated home loan firm or on-line loan provider, or you can ask a home loan broker to do everything for you. Home loan brokers put simply, are intermediaries that work as intermediaries in between consumers and also lenders. The use of mortgage brokers has actually waned over the last decade, numerous homebuyers are considering this route when again due to the special value it can offerparticularly for those that are freelance, have no W2 revenue, or are managing poor credit history. A mortgage broker aids customers locate the finest financing as well as guides them with the process.

Getting My Refinance Melbourne To Work

:max_bytes(150000):strip_icc()/dotdash-090915-mortgage-broker-vs-direct-lenders-which-best-Final-c7e52f06ff4f41bca0744429ee1838e3.jpg)

Some mortgage brokers use "no-cost" car loans, however you will still spend for the service with the rate of interest. Before working with a home loan broker, make certain to look into the broker and also carry out a testing interview. A home mortgage broker has 2 jobs: initially, to help you discover the very best loan product and also home mortgage price for your home acquisition, and also second, to assist you through the certification and also finance authorization process.

They'll seek to locate you the most effective finance item for your unique credit rating, earnings, as well as homebuying scenario, and they'll assist you focus in on the most affordable rate of interest possible. They'll likewise spearhead the entire mortgage process. https://123bizlisting.com/mortgage-broker/unicorn-financial-services-springvale-victoria/. Your broker will certainly gather up your paperwork, submit all your applications, and work with your picked lending institution to obtain your finance refined rapidly as well as effectively.

Mortgage brokers can be paid in a number of means. Some brokers use what are called "no-cost" loans, which means the borrower pays no cost or cost to function with the broker.

The large difference in between mortgage brokers as well as traditional lending police officers is that brokers are paid on a per-transaction basis. They stand to earn much more with every finance they refine and also obtain paid more on larger-size car loans. Finance police officers, on the various other hand, get a set annual income, so they're not as motivated by quantity or funding size.

Unicorn Financial Services Fundamentals Explained

They are not limited in geography and also can commonly touch local, statewide and also also nationwide lending institutions. They can typically have particular costs waived because of their loan provider partnerships. They save time as well as deal quicker application and closing procedures. Cons Brokers may use non-local lending institutions who are not acquainted with your area's nuances and also special needs.

Brokers might have much less control over your finance file and also exactly how it's refined, considering that it is not being taken care of inside. Homebuyers who have one-of-a-kind monetary circumstances (freelance, have inconsistent or non-W2 income or have less-than-stellar credit scores) are commonly best offered by a mortgage broker. Brokers are commonly extra knowledgeable about loan providers that will certainly loan to these kinds of non-traditional consumers Extra resources and can, therefore, assistance find the ideal car loan items as well as prices readily available to them. https://bellslocaldirectory.com/mortgage-broker/unicorn-financial-services-springvale-victoria/.

If you don't have time to search for a home loan yourself (a must, provided the number of lenders and also varying prices available) or you require to ensure a quick turn-around on your application, a mortgage broker can additionally be a wise selection. If you do discover that a home loan broker is the finest relocation for your upcoming residence purchase, make sure to do your due persistance.

Unknown Facts About Refinance Broker Melbourne

Ask inquiries, as well as take into consideration speaking with a minimum of three brokers before choosing that to go with. Remember, the finance your broker locates you will certainly impact the next 10, 20, and even 30 years of your life. melbourne mortgage brokers. Make sure they're educated, connected, and also equipped to offer you the absolute best item for your needs, and also ask friends, family members, as well as your realty representative for recommendations.

There are many options when it involves discovering finding a mortgage. At the end of the day, you'll want something that makes the procedure as streamlined as well as hassle-free as possible. Instead approaching a bank right off the bat, have you ever before considered utilizing a home loan broker? Enlisting the services of a home loan broker has a variety of advantages that can make discovering your initial mortgage a seamless experience, permitting you and your family members to focus on looking for the best building.

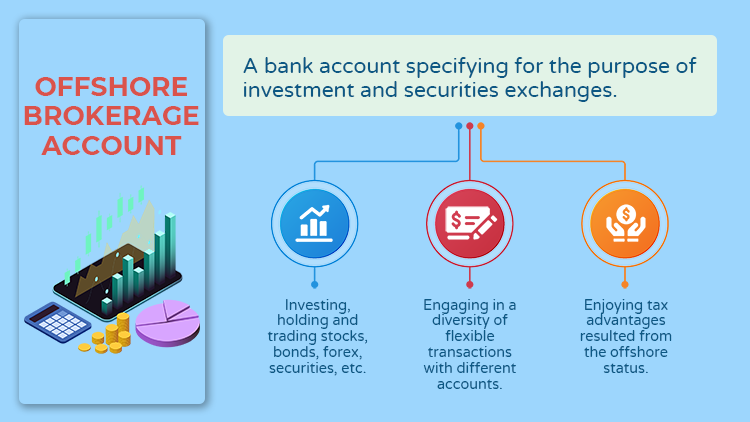

They likewise incorporate offshore, many say, to stay clear of paying tax obligations twice on the same pot of cash. Professionals state that such defenses are either overblown or mythical. Would like to know even more? View our press reporter Simon Bowers provide a TED Speak about revealing the tax obligation tricks of Nike and Apple in the Heaven Papers.

They likewise incorporate offshore, many say, to stay clear of paying tax obligations twice on the same pot of cash. Professionals state that such defenses are either overblown or mythical. Would like to know even more? View our press reporter Simon Bowers provide a TED Speak about revealing the tax obligation tricks of Nike and Apple in the Heaven Papers.